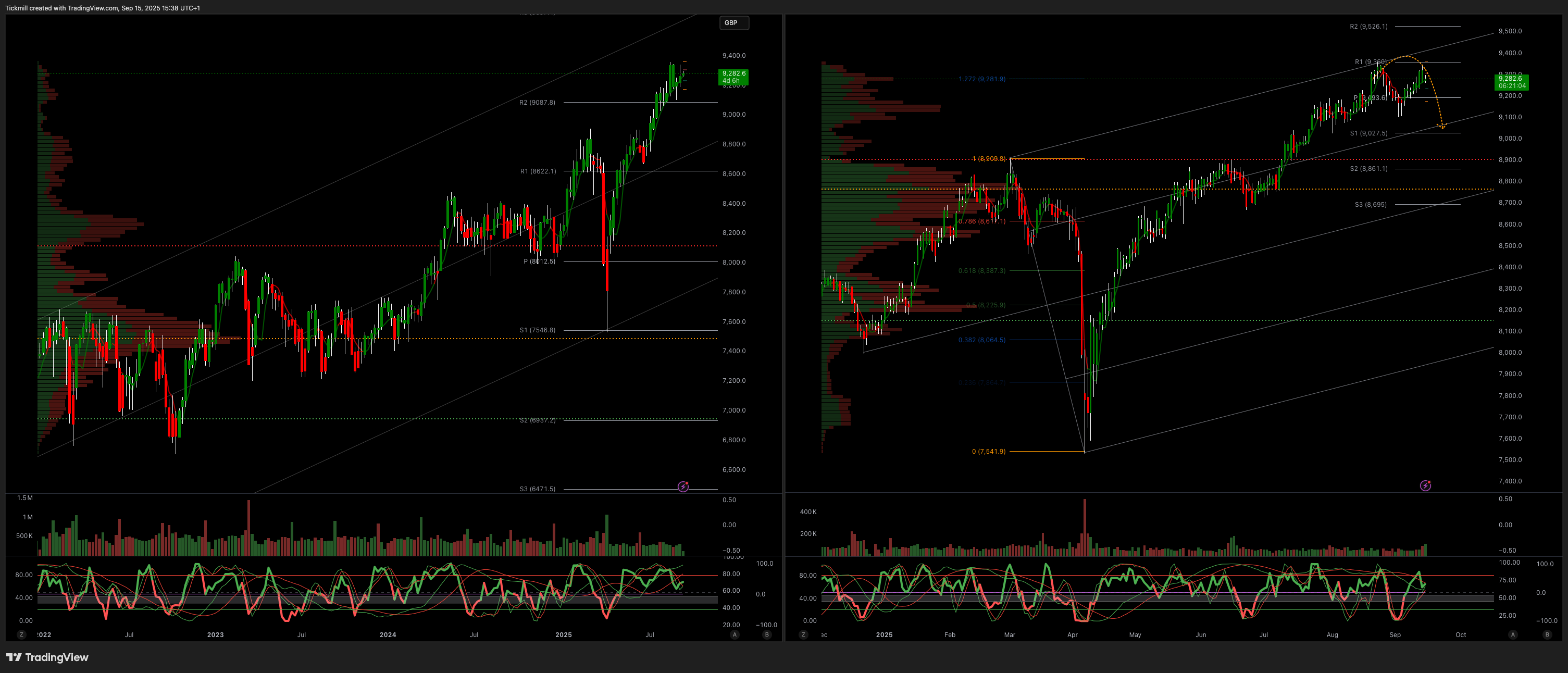

THE FTSE FINISH LINE 15/9/25

THE FTSE FINISH LINE

The benchmark FTSE 100 index of the UK stock market is marginally in the green into the close Monday. Mining company shares are struggling due to recent data indicating a decline in China's industrial output for August. Investors are looking forward to significant policy announcements from both the Federal Reserve and the Bank of England later this week. The Bank of England is anticipated to maintain current interest rates, while the U.S. Federal Reserve is generally expected to reduce its interest rate by 25 basis points, or possibly more.

Sainsbury's shares increased by 3.1% to 316.8p, making it the top percentage gainer on the FTSE 100 index. The stock reached its highest point in over four years. On Sunday, the supermarket chain announced that it had terminated negotiations with JD.com regarding the sale of its Argos general merchandise retailer. The company stated, "JD.com has indicated that it would only be willing to proceed under significantly altered terms and commitments that would not serve the best interests of Sainsbury's shareholders, employees, and wider stakeholders." SBRY has risen nearly 15% year-to-date.

AO World shares increased by 10.3% to 92p, leading the FTSE midcap index. The company has raised its fiscal year adjusted profit before tax forecast to between 45 and 50 million pounds ($61.0–67.8 million), up from the previous estimate of 40 to 50 million pounds. Additionally, it announced its first-ever share buyback program of up to 10 million pounds. So far this year, the stock has decreased by approximately 12%.

Shares of Martin Sorrell's advertising company S4 Capital plummeted by as much as 14% to 19.48p, reaching a record low. The firm anticipates its annual like-for-like net revenue to decrease by mid-single digits, compared to the earlier prediction of a low-single-digit decline. Peel Hunt has lowered its target price from 30p to 25p but continues to rate the stock as "hold." According to Peel Hunt, "We believe the top line must return to a consistent positive trend, and margins need further improvement for a re-rating." Out of seven brokerages, two give the stock a "buy" rating or higher, while five have it rated as "hold," with a median target price of 37.96p, based on data compiled by LSEG. As of the last close, S4 Capital shares are down approximately 31% year-to-date.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!