Institutional insights: Goldman Sachs 'Crypto; Shifting Sentiments'

Shifting Sentiments

Last week, markets experienced an initial sell-off driven by new tariff and trade developments ahead of the US-China trade meetings and sanctions on Russian oil companies. The S&P 500 declined for the month, while BTC and ETH hit weekly lows at $106k and $3.7k, respectively. However, sentiment shifted mid-week as encouraging corporate earnings and a softer-than-expected September CPI (core +3.02% YoY vs. +3.11% prior) revived risk appetite (see: "USA: Core CPI Softer Than Expected; Estimating 0.24% for September Core PCE"). By the end of the week, the S&P 500 closed 1.91% higher at $6,791, BTC climbed to the $111k-$112k range, and ETH rose to the $3.9k level.

Sentiment further improved over the weekend following reports that the US and China had reached a framework for a trade deal ahead of the Trump-Xi meeting (Bloomberg). Cryptocurrencies gained momentum on this news, with BTC surging to $116k and ETH reaching $4.2k by Monday’s open, liquidating nearly $350 million in short positions (The Block). Since then, equities have extended their rally, with the S&P 500 hitting new all-time highs, touching $6,900, fuelled by continued positive earnings momentum and resilient risk sentiment. Meanwhile, crypto markets have lagged.

October Seasonality

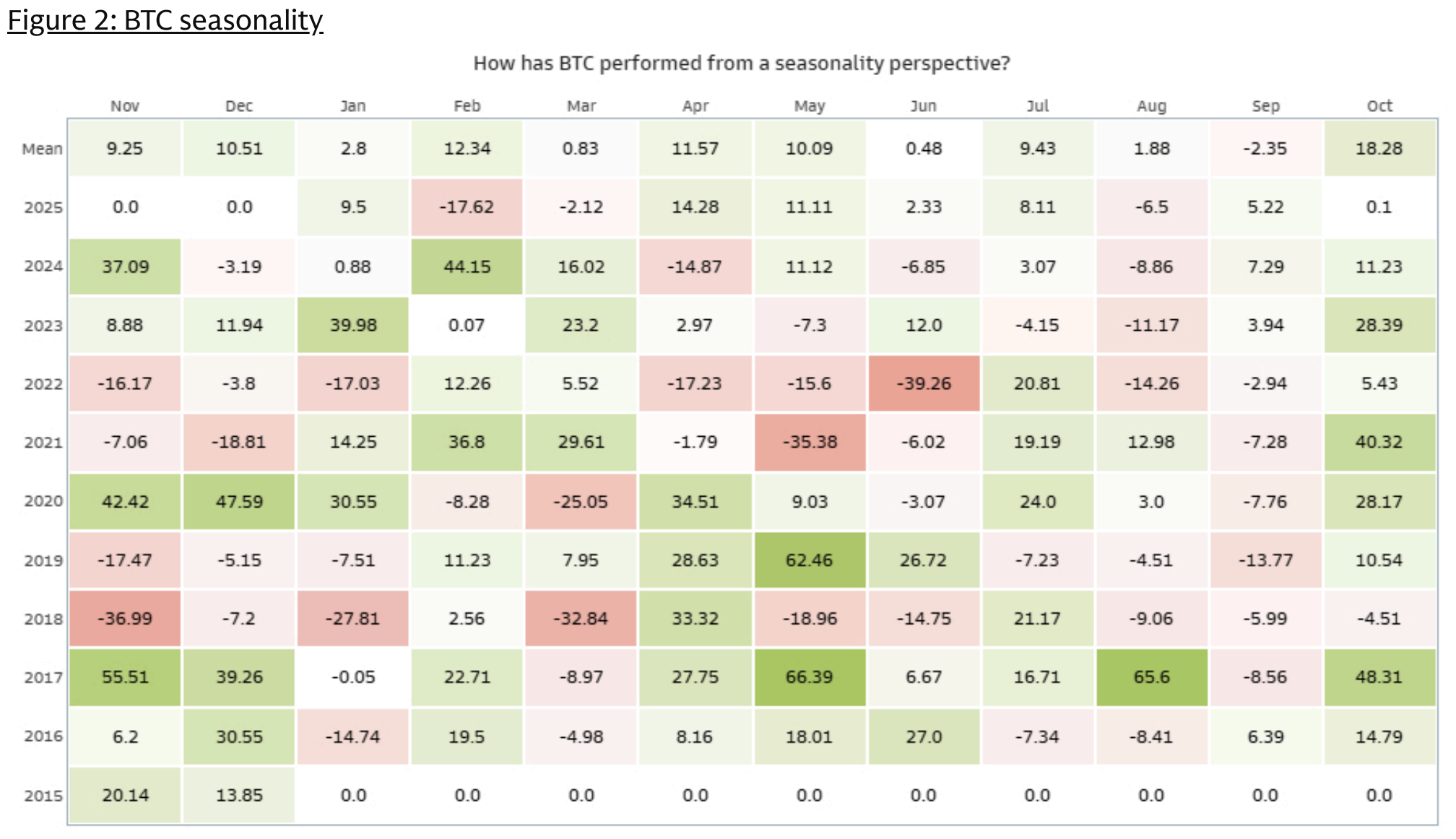

Referring to our earlier analysis on BTC seasonality, over the past 9 years, only one October has ended in the negative. Despite the significant liquidations on October 11 (Coinglass), which resulted in single-day drawdowns of approximately 10.5%, BTC’s month-to-date performance remains nearly positive (Figure 2).

A historical perspective on BTC and shifts in M2 Money Supply

As we approach the upcoming Federal Reserve meetings, it’s valuable to examine the historical correlation between BTC and changes in M2 money supply—a relationship that has generally been positive.

Options Markets

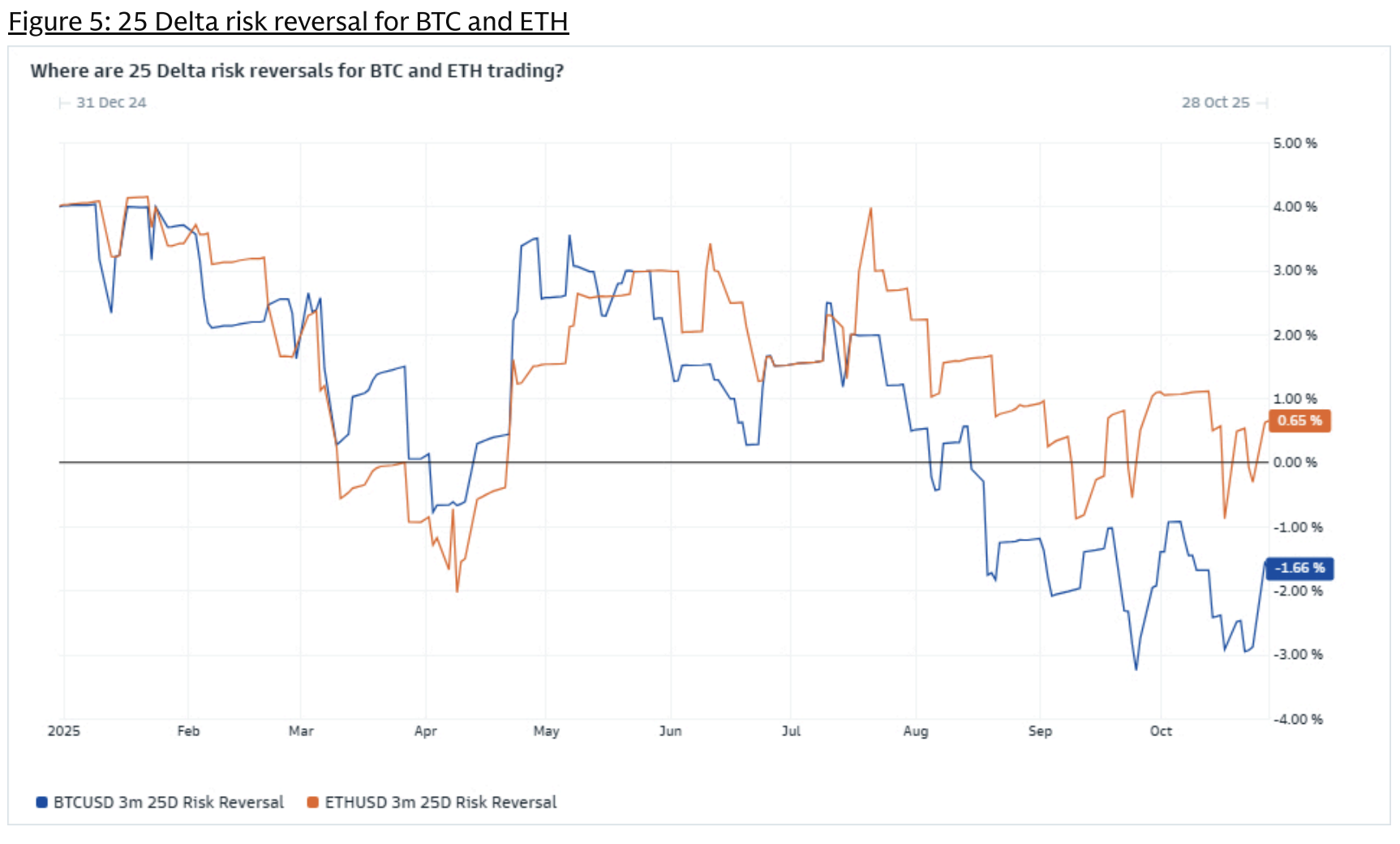

The recovery in spot prices has been reflected in the options markets. As of Tuesday's New York close, 3-month 25-delta risk reversals have shifted higher, with ETH risk reversals returning to positive territory. This indicates a repositioning towards an upside bias, aligning with ETH's trend for most of the year.

Leverage Post-October 11 Implied by Perpetual Funding Rates

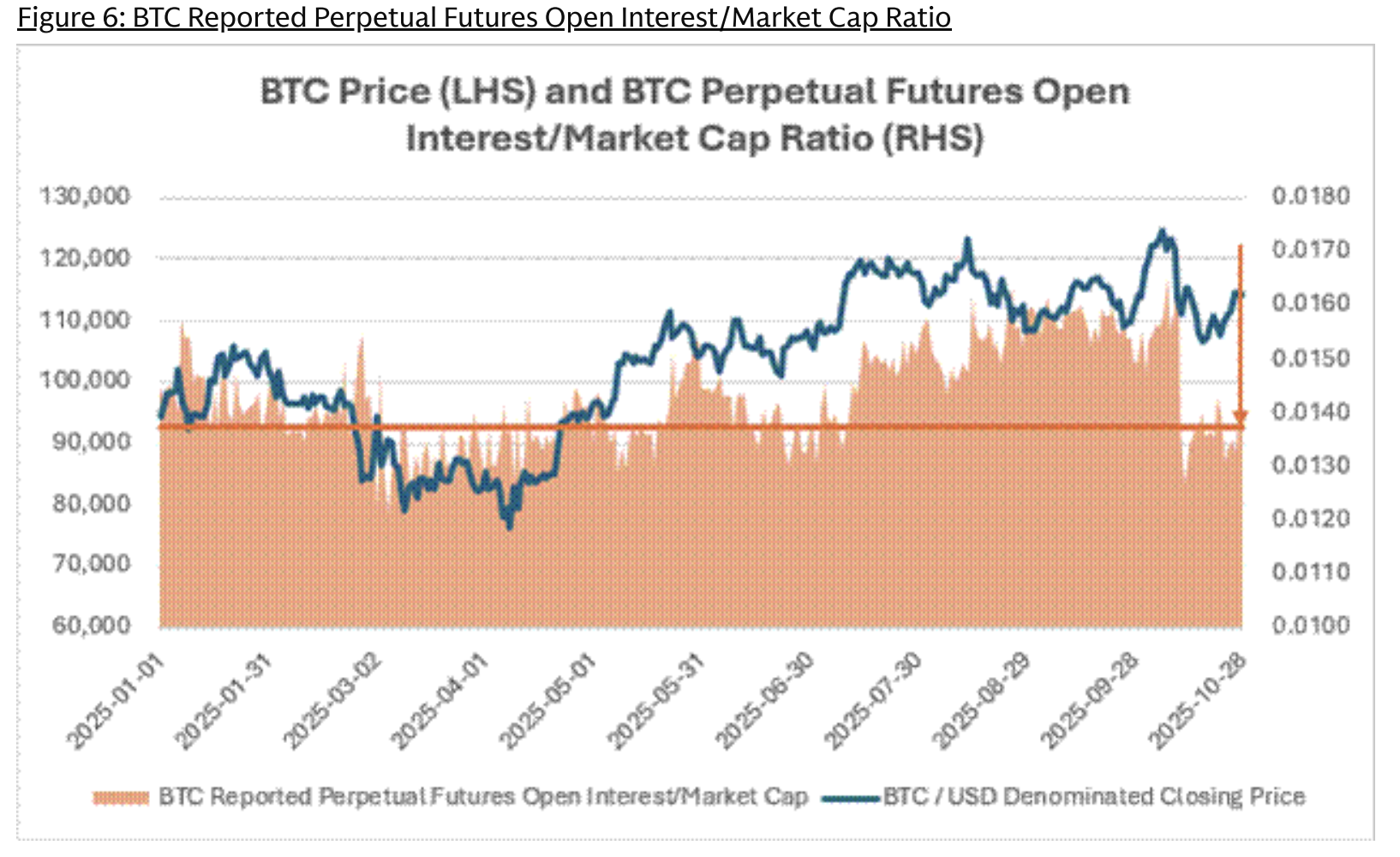

To assess the leverage within the system, we measure BTC Perpetual Futures open interest relative to its market capitalization. This ratio has significantly decreased following the liquidation cascade on October 11, now sitting below previous levels observed at comparable spot prices from July to September (Figure 6). This suggests a healthier market structure, characterised by reduced leverage compared to prior periods.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!