FTSE 100 FINISH LINE 6/10/25

FTSE 100 FINISH LINE 6/10/25

On Monday, London's FTSE 100 index experienced a dip as investors paused following last week's surge that brought the index to all-time highs. Shares of packaging firm Mondi declined after releasing its quarterly results, contributing to the downturn. The blue-chip index had briefly surpassed the 9,500 mark for the first time, marking its fifth straight session of record highs, before reversing direction. The industrial sector declined by 3.9%. Mondi saw a significant drop of 15.4%, reaching a 12-year low, as the packaging firm reported a slowdown in growth for its core profit in the third quarter due to weak demand and reduced prices. Additionally, investors in the UK and EU were unsettled by the surprising resignation of France's new prime minister, Sebastian Lecornu, along with his government, on Monday, just hours after he revealed his cabinet. This made the administration the shortest-lived in contemporary French history.

Citigroup has significantly downgraded UK equities from "overweight" to "underweight." The firm noted that the market's reliance on defensive sectors like consumer staples and utilities renders it less appealing amid a climate that favors cyclical and growth-focused investments. Healthcare stocks increased by 0.1%. This sector contributed to the FTSE 100's gains last week, achieving its strongest weekly performance since October 2008. Investor interest revived in this previously struggling sector following a deal between the U.S. administration and drug company Pfizer, which alleviated some of the uncertainties surrounding it.

Shares of Mondi, a British packaging and paper manufacturer, fell by 17.5% to 864.2 p, making it the biggest loser on London's FTSE 100. The company's Q3 underlying core profit plummeted 22% from Q2 to 223 million euros ($260.1 million) due to weak demand and price pressures. Mondi anticipates challenging conditions will continue throughout the remainder of 2025, attributed to fragile customer confidence, oversupply, and declining selling prices. The company expects its major projects to contribute approximately 30 million euros to EBITDA in FY2025. Analysts from Jefferies noted that the overall outlook for the paper and packaging sector is negative, mainly due to weak demand linked especially to graphic paper. Shares of Nordic forestry companies Stora Enso, UPM, and SCA dropped between 2% and 5%. As of Friday's close, the stock had decreased by around 11.5% this year.

Shares of Aston Martin, the British luxury car manufacturer, have decreased by 10.2%, falling to 73p, making it the largest loser on the FTSE mid-250 index. The company anticipates that its full-year adjusted operating loss will be at the lower end of its own market consensus estimate, projecting a loss of £110 million ($147.77 million). It expects a decline in wholesale volumes for the fiscal year, with a reduction in mid- to high-single digits from the previous year’s total of 6,030 units. The company has also commenced a review of its future spending on costs and capital. Nonetheless, Aston Martin predicts that profitability and free cash flow for fiscal year 2026 will significantly improve compared to fiscal year 2025. As of the last closing, the stock has dropped approximately 24% year-to-date.

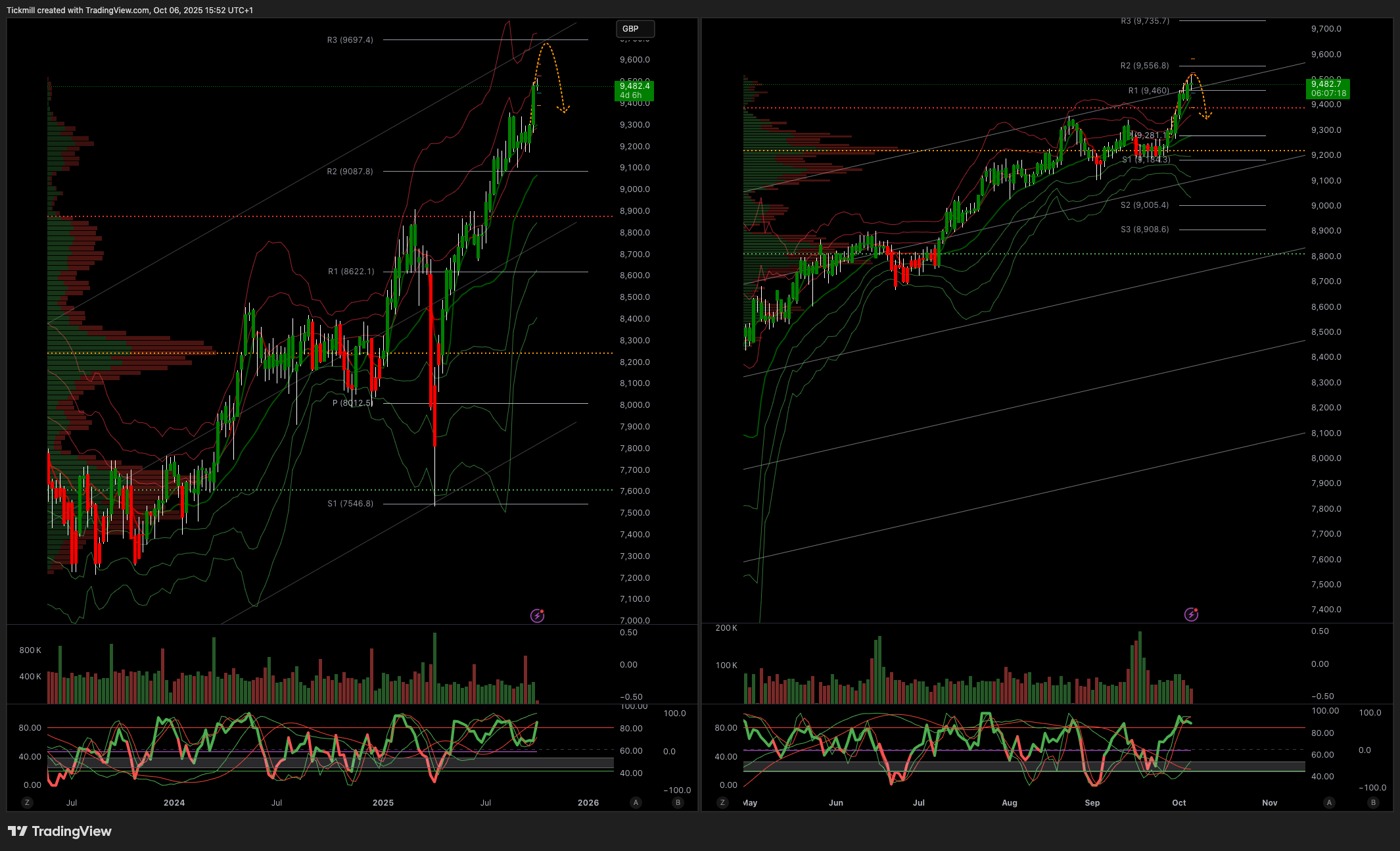

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9300

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!