Daily Market Outlook, January 30, 2024

Daily Market Outlook, January 30, 2024

Munnelly’s Market Minute…“Eurozone Q4 GDP Eyed”

Asian markets saw a mixed trading session with the momentum from Wall St's record highs offset by weakness in China. The Nikkei 225 initially rose after a surprise drop in Japan's unemployment rate, but later gave up most of its gains. This evening, the Bank of Japan will release a summary of this month’s policy meeting, during which interest rates were left unchanged and remain in negative territory. However, in comments following the meeting, BOJ Governor Ueda appeared to suggest that rates could begin to rise starting from the spring. Consequently, today's summary will be closely scrutinized for indications of whether this is indeed a realistic possibility.Hang Seng and Shanghai Comp were under pressure as attention shifted to earnings releases, with Hong Kong experiencing losses in property and tech sectors. Additionally, the Hong Kong government initiated the process of passing new national security laws.

The upcoming Eurozone Q4 GDP data will give us an understanding of the level of economic activity at the end of 2023. If there is a further decline following the 0.1% decrease in Q3, it could signal a recession at the year-end. We predict that there will be no change in overall output for the region, narrowly avoiding meeting the technical definition of a recession (which requires at least two quarters of negative growth). However, certain member countries, particularly Germany, may see declines in their GDP. Given the recent update on monetary policy, it is expected that the European Central Bank will cut interest rates in April, and today's data is unlikely to change those expectations. Furthermore, we will also receive January's consumer and business confidence data for the Eurozone. The consumer confidence figure, which is a second reading, initially showed a decrease from December but remained higher than recent lows. It is anticipated that business confidence will show a more positive outlook for the services sector compared to the industrial sector, which is still under significant pressure.

Before the Bank of England's update on Thursday, today's readings on money supply and lending will provide insights into how past interest rate hikes have impacted the economy. Of particular interest will be the figures on lending in the housing market, as there are indications that recent decreases in market interest rates are benefiting this sector. Expect that mortgage approvals will increase for the third consecutive month in December, reaching their highest level in four months.

Stateside, a crucial measure of consumer confidence is expected to increase for the third consecutive month in January, reaching its highest level since last July. This likely reflects the impact of lower inflation rates and expectations of interest rate cuts.

Overnight Newswire Updates of Note

Japan Job Market Remains Tight, Keeping Hopes For Wage Hikes

Australia December Retail Sales Slump, Sending Bonds Higher

DUP Agrees Deal With UK Government To Restore Power Sharing To Northern Ireland

RBNZ Chief Economist Says MonPol Working But Still Work To Be Done

Japan PM Keeps Up Push For Higher Wages As Election Talk Swirls

DOJ And SEC Unveil Charges In $1.9 Bln HyperFund Cryptocurrency Fraud

Binance Bows To Trader Demands To Keep Their Assets Elsewhere

Boeing Withdraws Bid For Safety Exemption For Boeing 737 MAX 7

Northrop Grumman Announces $1 Bln Accelerated Share Buyback Agreement

Toyota Holds Lead As World’s No. 1 Carmaker For Fourth Year

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (235M), 1.0815-25 (1.1BLN), 1.0865-75 (889M)

GBP/USD: 1.2875 (388M)

AUD/USD: 0.6635-40 (414M), 0.6675 (328M)

USD/JPY: 146.60-70 (600M), 147.20 (580M), 148.00 (548M)

AUD/JPY: 94.00 (1.2BLN)

The increase in EUR/USD option prices reflects concerns about potential downside risk and upcoming data releases before the Federal Reserve meeting. The decline in the EUR/USD spot price has led to an increase in demand for options and higher premiums. Implied volatility has risen across the entire curve since Friday, with traders also keeping an eye on upcoming economic data from the Eurozone and the U.S. The U.S. Federal Reserve's upcoming decisions are also a factor, although they may not significantly impact foreign exchange volatility. The benchmark 1-month expiry now stands at 6.5, up from a long-term low of 6.0, while the 1-year expiry has increased to 7.0 from 6.85, with recent support from U.S. election risk. There has also been a slight increase in demand for downside strike premiums this week.

CFTC Data As Of 12/01/24

USD bearish increasing -9,298

CAD bearish increasing -992

EUR bullish decreasing 14,150

GBP bullish increasing 2,443

AUD bearish increasing -3,151

NZD neutral neutral -177

MXN bullish neutral 2,370

CHF bearish neutral -542

JPY bearish neutral -4,803

Technical & Trade Views

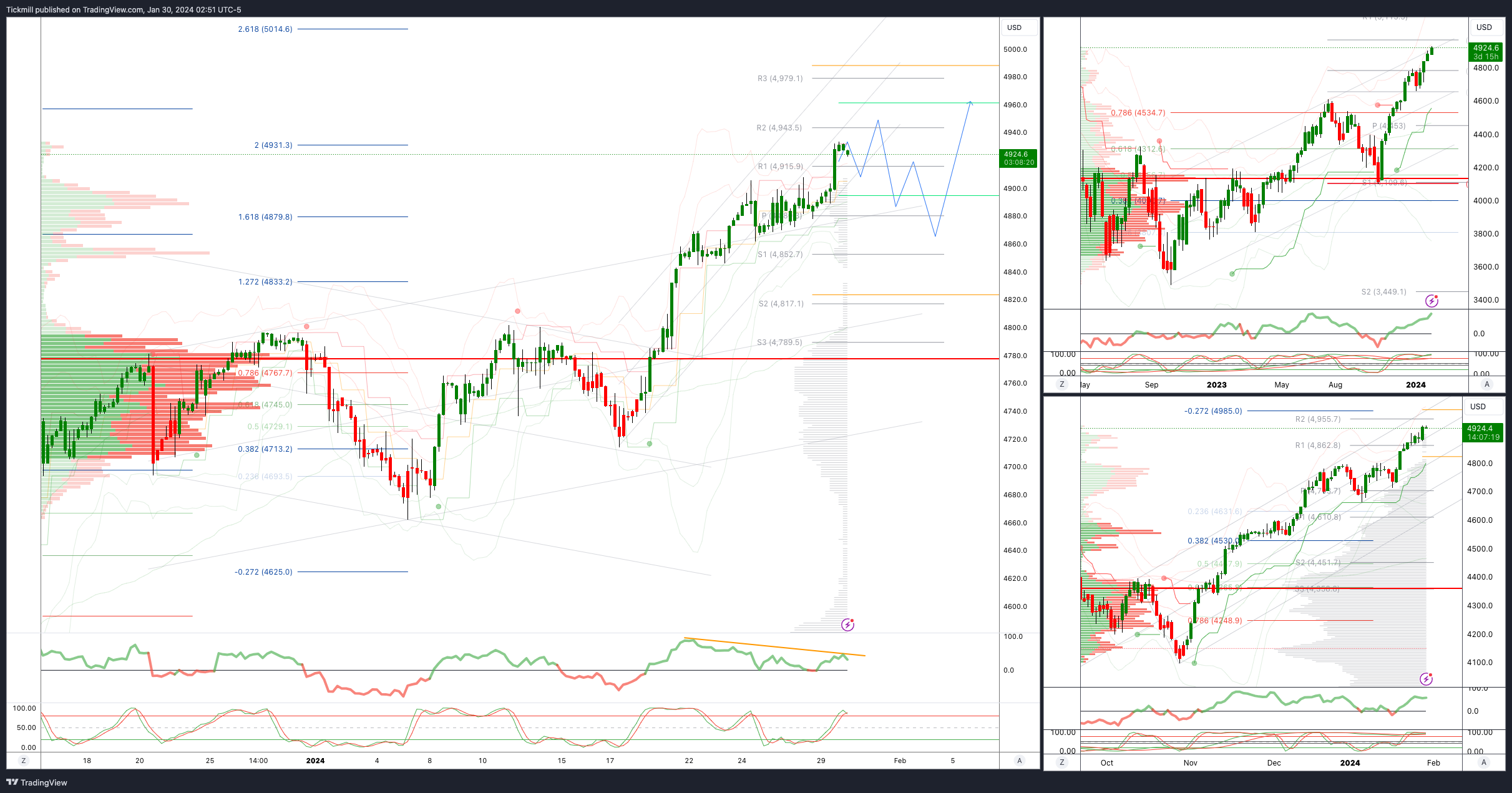

SP500 Bullish Above Bearish Below 4900

Daily VWAP bullish

Weekly VWAP bullish

Below 4900 opens 4870

Primary support 4800

Primary objective is 4910 Target Hit New Pattern Emerging

EURUSD Bullish Above Bearish Below 1.0930

Daily VWAP bearish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

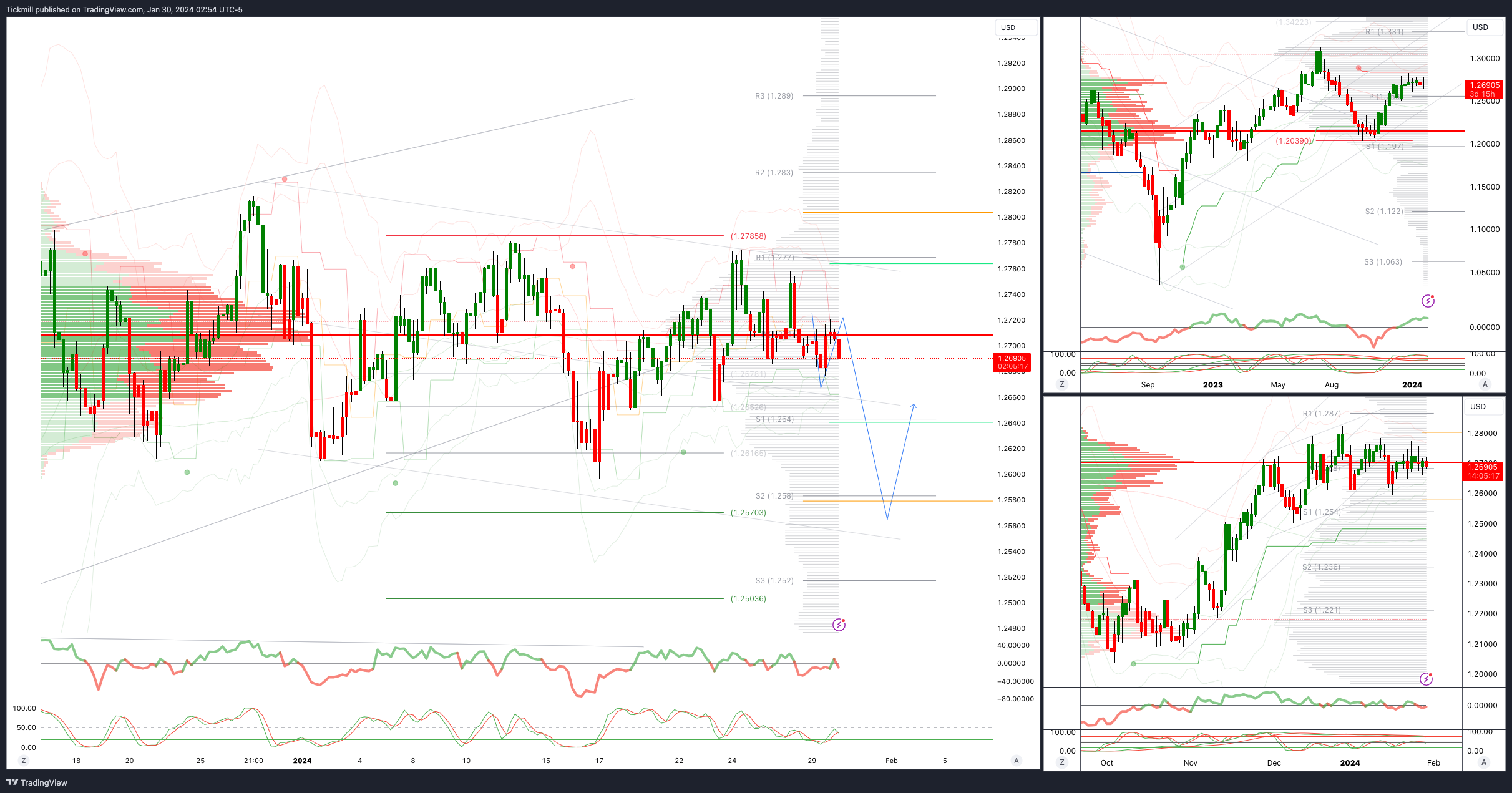

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

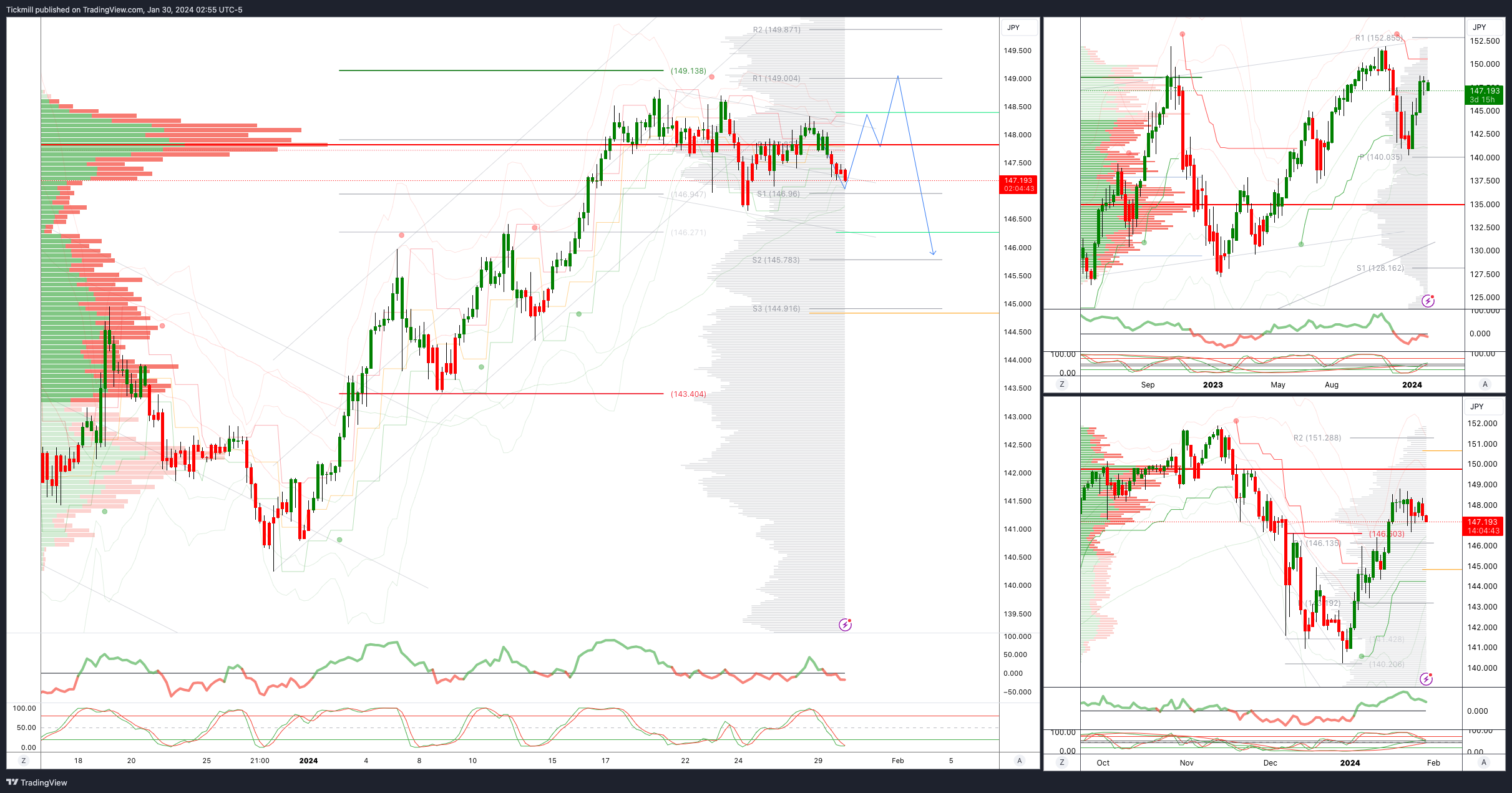

USDJPY Bullish Above Bearish Below 146.40

Daily VWAP bearish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149

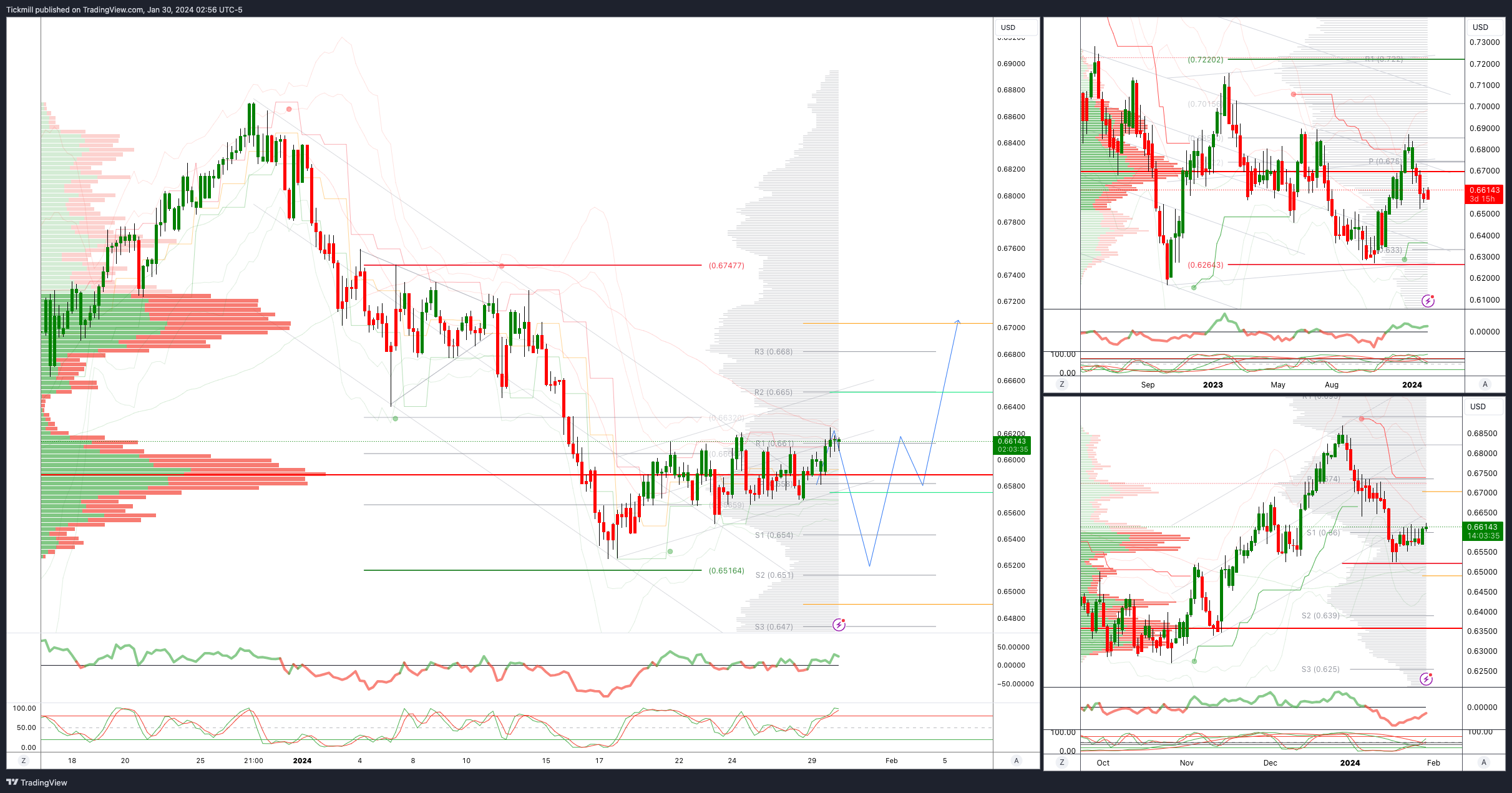

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bullish

Weekly VWAP bearish

Above .6680 opens .6550

Primary support .6525

Primary objective is .6933

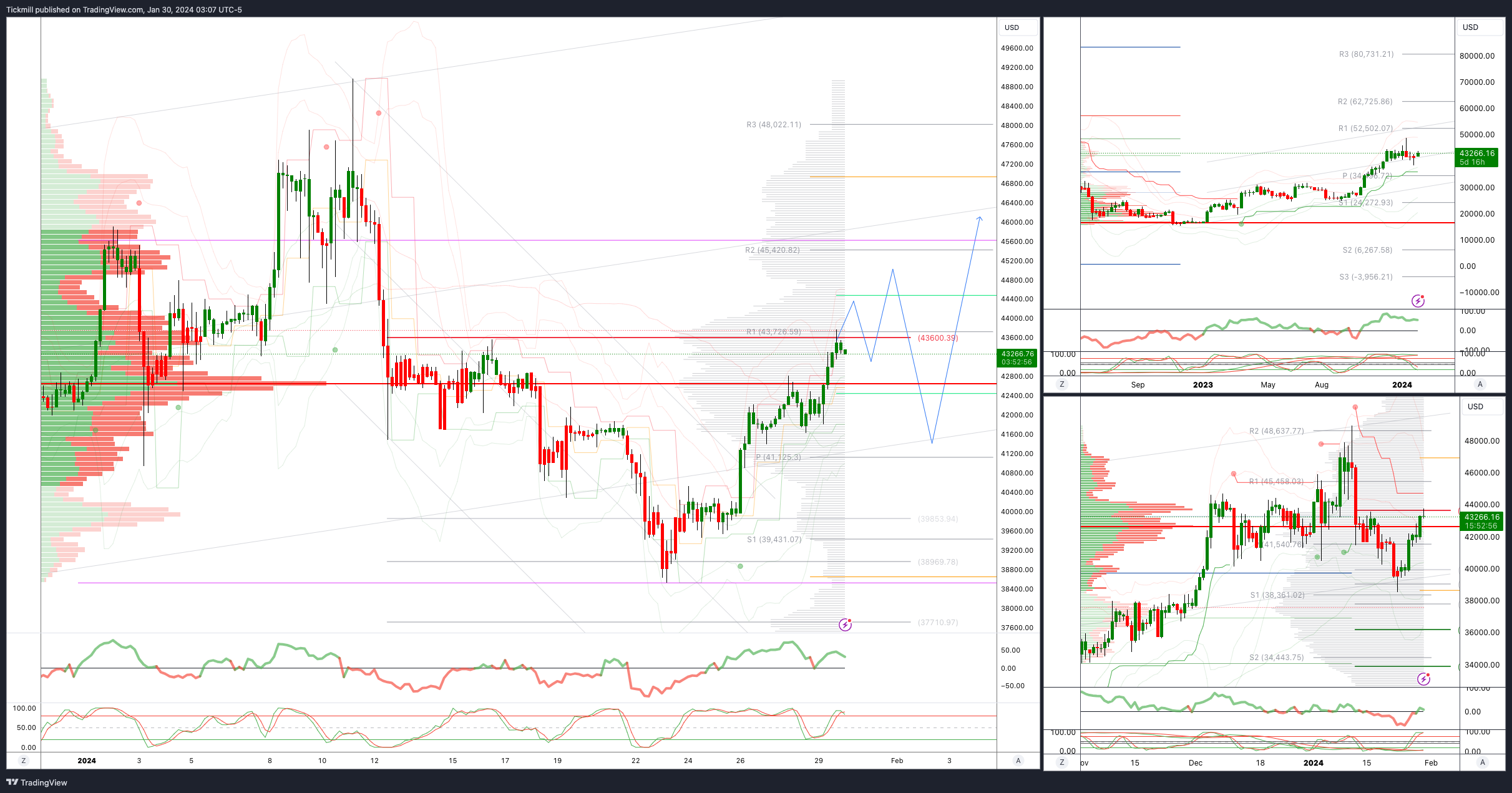

BTCUSD Bullish Above Bearish below 43600

Daily VWAP bullish

Weekly VWAP bullish

Above 43600 opens 46000

Primary resistance is 43600

Primary objective is 45600

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!