Bitcoin Testing Key Support Level Ahead of US Data

Bitcoin Weaker on Friday

Bitcoin prices are ending the week at lows with the market down heavily yesterday as USD rallied in response to better-than-forecast US data. Weekly jobless claims were seen dropping to their lowest level in months while final quarterly GDP was seen surprising to the upside. The data fuelled a strong uptick in USD as shorts covered their positions, echoing the softening of easing expectations. CME pricing for an October cut has fallen back below the 90% level. With USD rallying, risk assets have cooled into the end of the week, taking bitcoin and the broader crypto market lower.

US Core PCE Due

Looking ahead today, traders will now be focusing on US inflation data with core PCE due this afternoon. Given the strength in jobs and GDP data yesterday, any upside surprise is likely to lead to a furtehr weakening of near-term US easing prospects. On this scenario, BTC is vulnerable to a sharp drop lower as USD rallies near-term. In terms of numbers today, the market is looking for core PCE to soften to 0.2% from 0.3%. If a drop is confirmed, this should help keep near-term easing prospects healthier, allowing some recovery action in BTC and risk assets generally. A downside surprise would be the ideal scenario for BTC bulls today, helping to shift the focus away from yesterday’s strong US data.

Technical Views

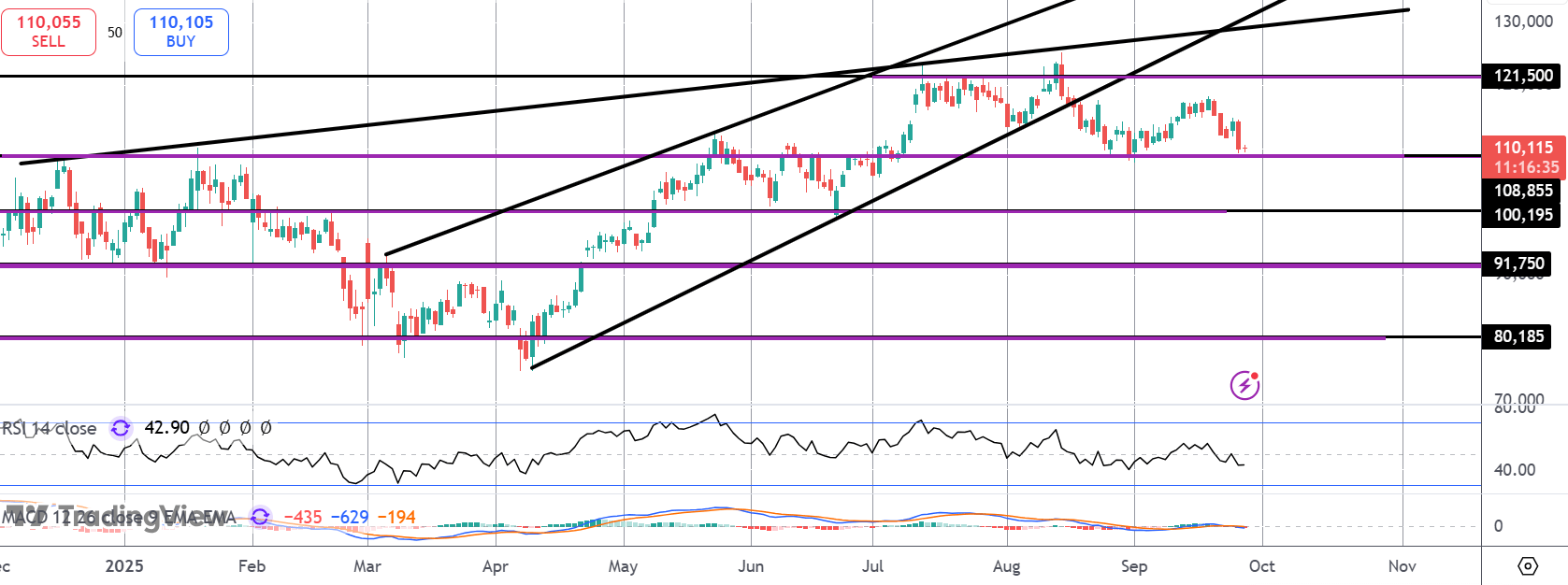

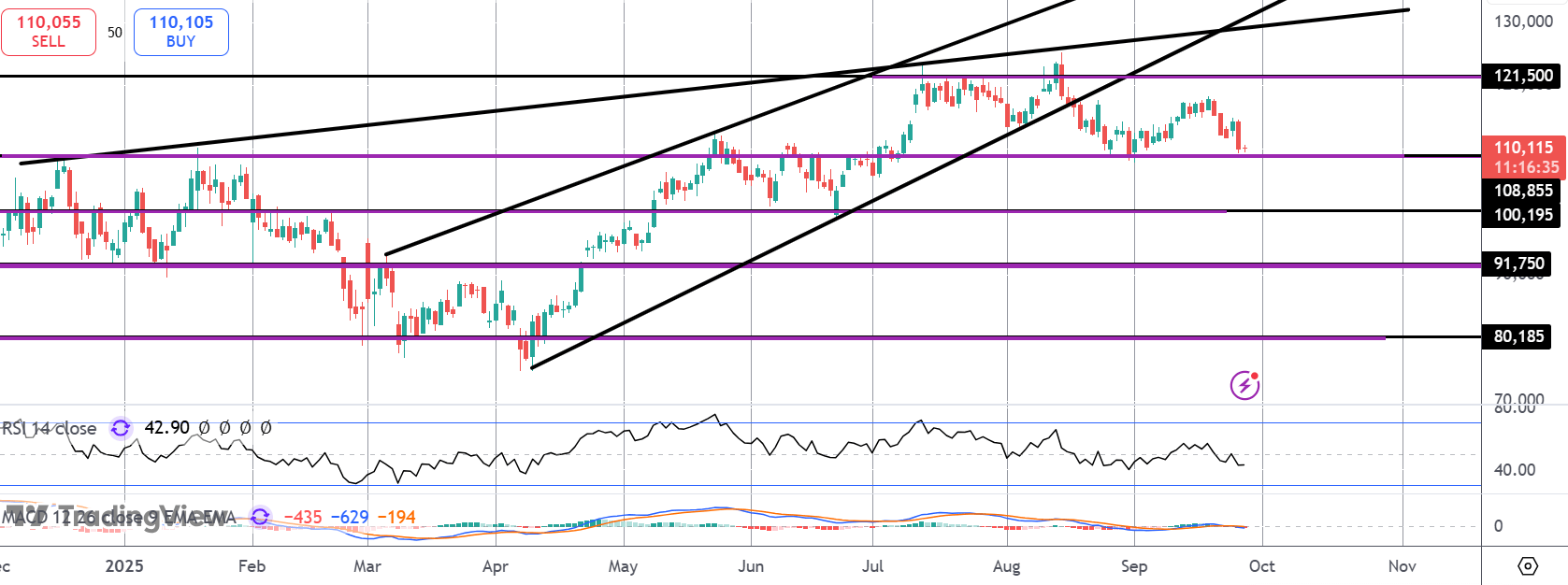

BTC

For now, BTC remains atop the $108,855 level, keeping the broader bull trend in play. However, with momentum studies bearish, risks of a drop lower are seen with the $100k mark the key level to watch next. This remains the longer-term line in the sand which, if broken, will cause a bearish reassessment of the near-term outlook for BTC.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.