Daily Market Outlook, June 29, 2023

Munnelly’s Market Commentary…

Asian equity markets traded with mixed results as indecision prevailed heading towards the end of the month, quarter and half year. The performance followed a volatile session in the US, where global markets digested the recent central bank rhetoric from the Sintra Forum. Most central bankers, including Fed Chair Powell, signalled the likelihood of further rate increases. The Nikkei 225 extended its gains, briefly surpassing the 33.5K handle, supported by the recent strength of USDJPY and better-than-expected Japanese Retail Sales. However, the Hang Seng and Shanghai Composite remained subdued due to ongoing trade frictions and the possibility of additional US tech export restrictions on China. The losses in the mainland markets were cushioned by the continued liquidity efforts of the People's Bank of China.

In the UK, market participants will be parsing upcoming data releases including the Bank of England's money and credit data, the second estimate of Q1 GDP, and the Lloyds Business Barometer. Mortgage approvals, which have shown stabilisation in recent months, are expected to improve in the latest figures for May. Q1 GDP growth is anticipated to remain unchanged at 0.1% quarter-on-quarter. The Lloyds Business Barometer report for June will provide insights into hiring intentions amid rising services inflation. Monetary Policy Committee member Tenreyro is scheduled to deliver a speech before leaving the Bank.

In the Eurozone, investor focus remains on national inflation releases ahead of tomorrow's Eurozone June flash CPI estimate. Italy reported a decline in annual inflation to 6.7%, while Spain's EU-harmonised inflation rate is expected to decrease to 1.5%. Germany's EU-harmonised inflation measure is forecasted to rise to 6.8%, driven by base effects. Overall, Eurozone inflation is projected to fall to 5.5% in June, but core CPI is expected to tick back up to 5.5%, adding pressure for the ECB to raise rates again next month. Survey evidence indicates a further fall in economic sentiment, reflecting a more pessimistic outlook among firms.

Stateside, a marginal upward revision to Q1 GDP growth to 1.4% (annualised) is possible, indicating continued strength in economic activity. However, attention will be on the weekly initial jobless claims data for further indications of the labour market's condition and any signs of softening.

Citi Quants Month End Rebalancing Expectations

Citi has published its preliminary estimate for month-end FX rebalancing, indicating a preference for selling USD. According to their model, both hedge and asset FX rebalancing requirements align in this direction. The estimate suggests that negative flows from US equities will have a significant impact on equity rebalancing. It is worth noting that month-end flows typically influence FX markets in the days leading up to the end of the month.

CFTC Data As Of 23-06-23

(USD net spec short grew in Jun 14-20 period; $IDX -0.76%

EUR$ +1.15% in period, specs -7,173 contracts into strength, now +144,649

$JPY +1.31% in period, JPY soft amid rate divergence, specs -3,680 contracts

GBP$ +1.21%, specs get long ahead of CPI/BoE, +39,873 contracts now +46,608

Specs guessed right higher CPI, +50bp BoE but GBP$ -150 pips from weeks high

AUD$ +0.3% in period, specs +12,129 contracts on hawkish RBA, now -33.5k

BTC +8.96%, specs 346 contracts into strength, halved long to +397 contractsSource: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0800 (2.9BLN), 1.0825 (628M), 1.840-50 (824M)

1.0895-1.0900 (1.8BLN), 1.0925-35 (637M), 1.0950-60 (919M), 1.1000 (1.5BLN)

USD/CHF: 0.8990-0.9000 (950M), 0.9010-20 (898M)

GBP/USD: 1.2665 (542M), 1.2700 (1BLN)

EUR/GBP: 0.8600 (919M) . AUD/USD: 0.6800 (789M)

AUD/NZD: 1.0850 (755M), 1.0955 (715M)

USD/JPY: 144.00 (1.3BLN), 1.4430-35 (627M), 144.50 (1.5BLN)

EUR/JPY: 156.00 (310M).

USD/CAD: 1.3150 (1BLN), 1.3200 (644M), 1.3225 (379M), 1.3250 (439M)

Overnight News of Note

Asia Markets Mixed Amid Fed Hints Of More Rate Hikes Ahead

More Tightening To Come, Top Central Bank Officials Warn

Banks Shrug Off Turmoil To Ace Fed's Annual Health Checks

Biden Tries To Flip Sceptical US Public On His Economic Plan

Yellen Says Hope Meet New Leaders On Possible China Trip

Banks Take Losses On Commercial Real Estate, Yellen Says

China Carries Yuan Support In Stronger-Than-Expected Fix

Chinese Balloon Used American Tech To Spy On Americans

BoJ May Tweak Yield Curve Control In Q3 2023, HSBC Says

Japan’s Retail Sales Rebound, Adding To Signs Of Recovery

Australian Retail Sales Exceed Forecasts, Spending Resilient

ECB's Centeno: Reaching Time When Policy May Pause Soon

Chipmaker Micron Beats On Booming AI Demand, Easing Glut

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

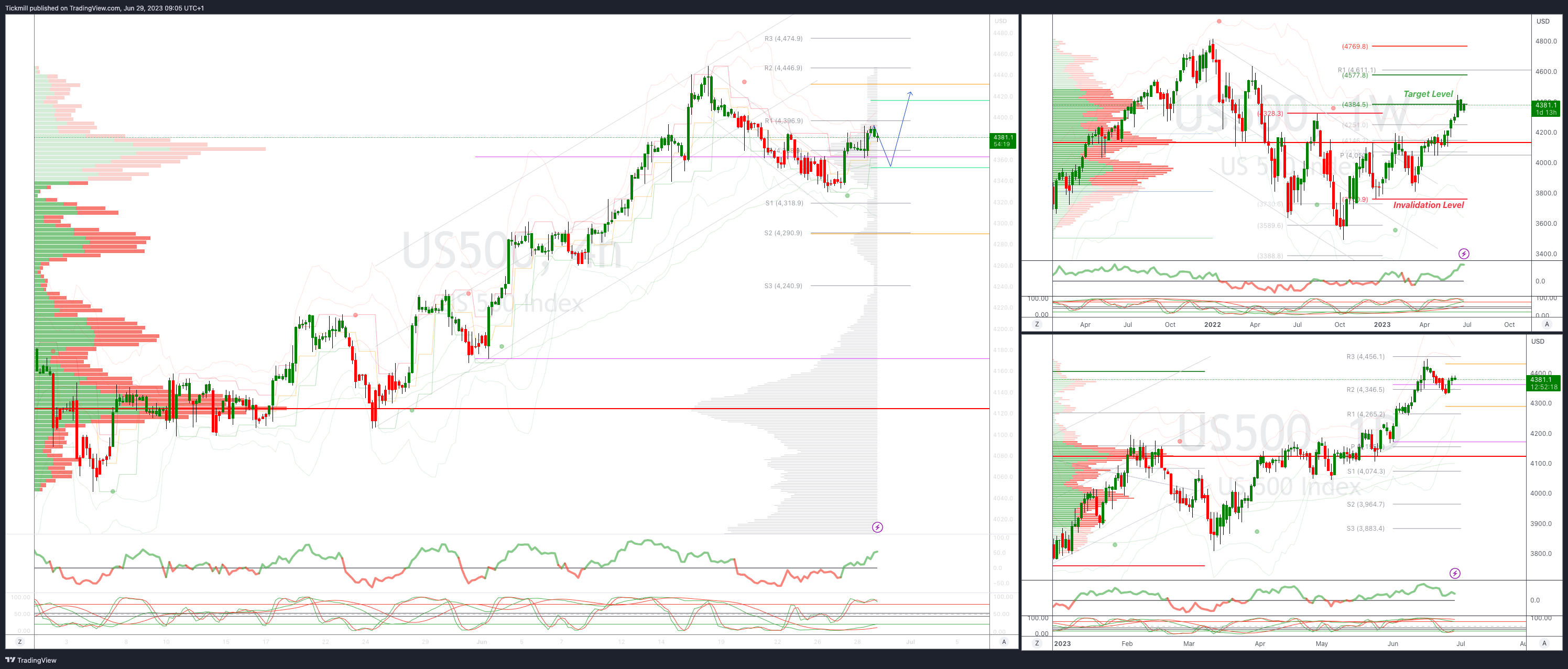

SP500 Bias: Intraday Bullish Above Bearish Below 4340

Below 4330 opens 4300

Primary support is 4300

Primary objective is 4580

20 Day VWAP bullish, 5 Day VWAP bullish

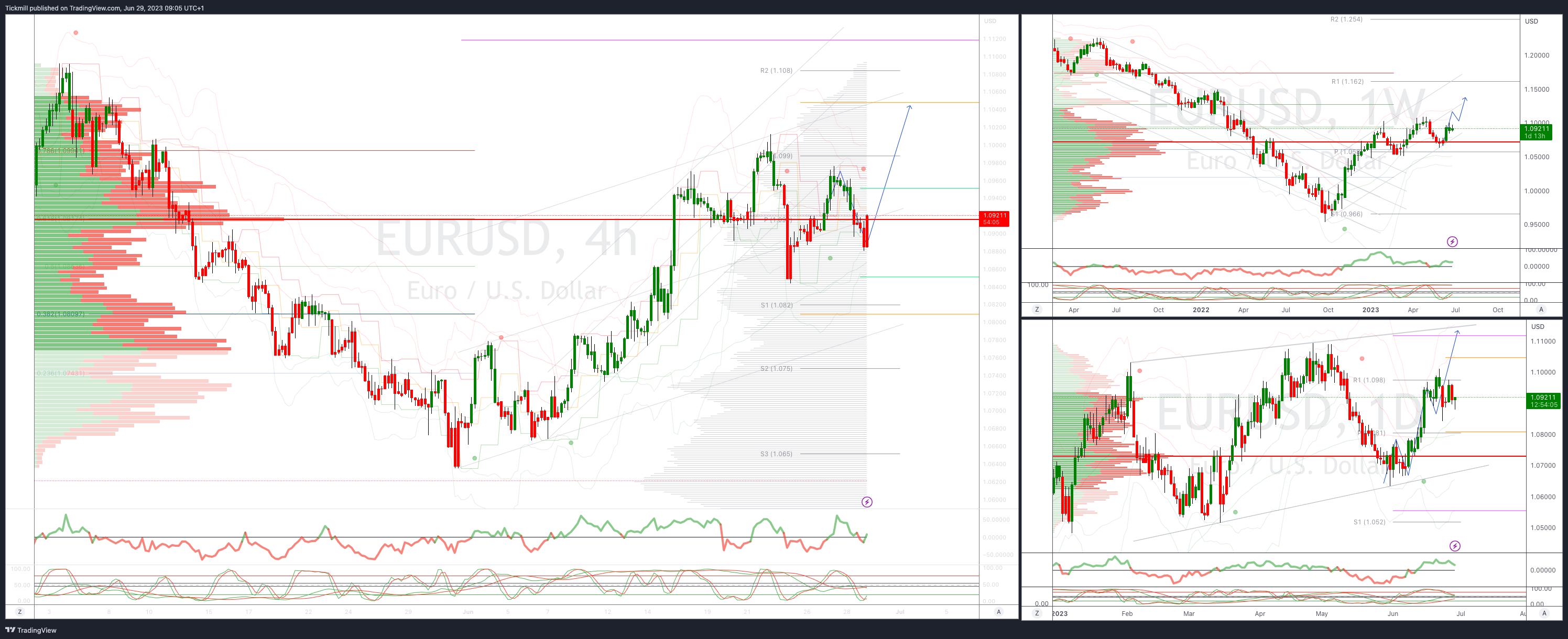

EURUSD Intraday Bullish Above Bearsih Below 1.0880

Below 1.0880 opens 1.0830

Primary support is 1.0666

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

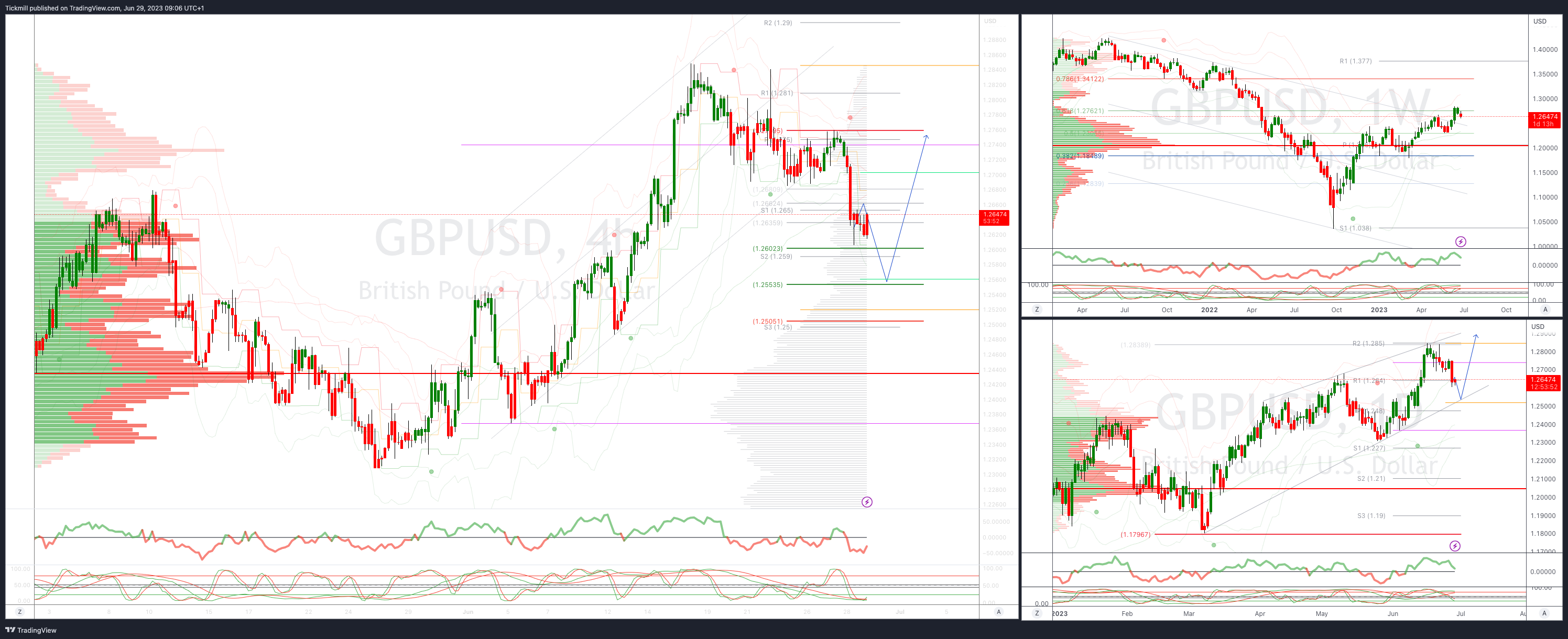

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2650

Below 1.26 opens 1.2550

Primary support is 1.2680

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bearish

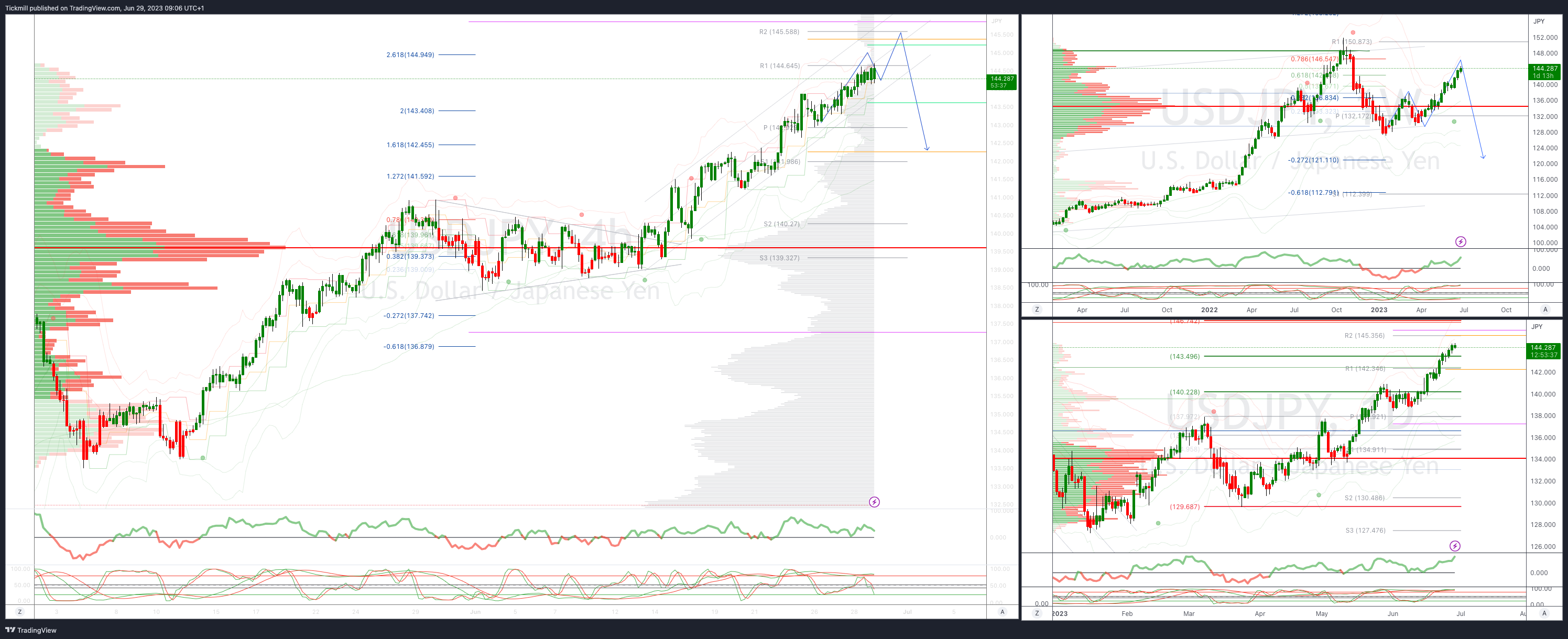

USDJPY Bullish Above Bearish Below 143.50 Target Hit, New Pattern Emerging

Below 143 opens 142.30

Primary support is 141

Primary objective is 145.50

20 Day VWAP bullish, 5 Day VWAP bullish

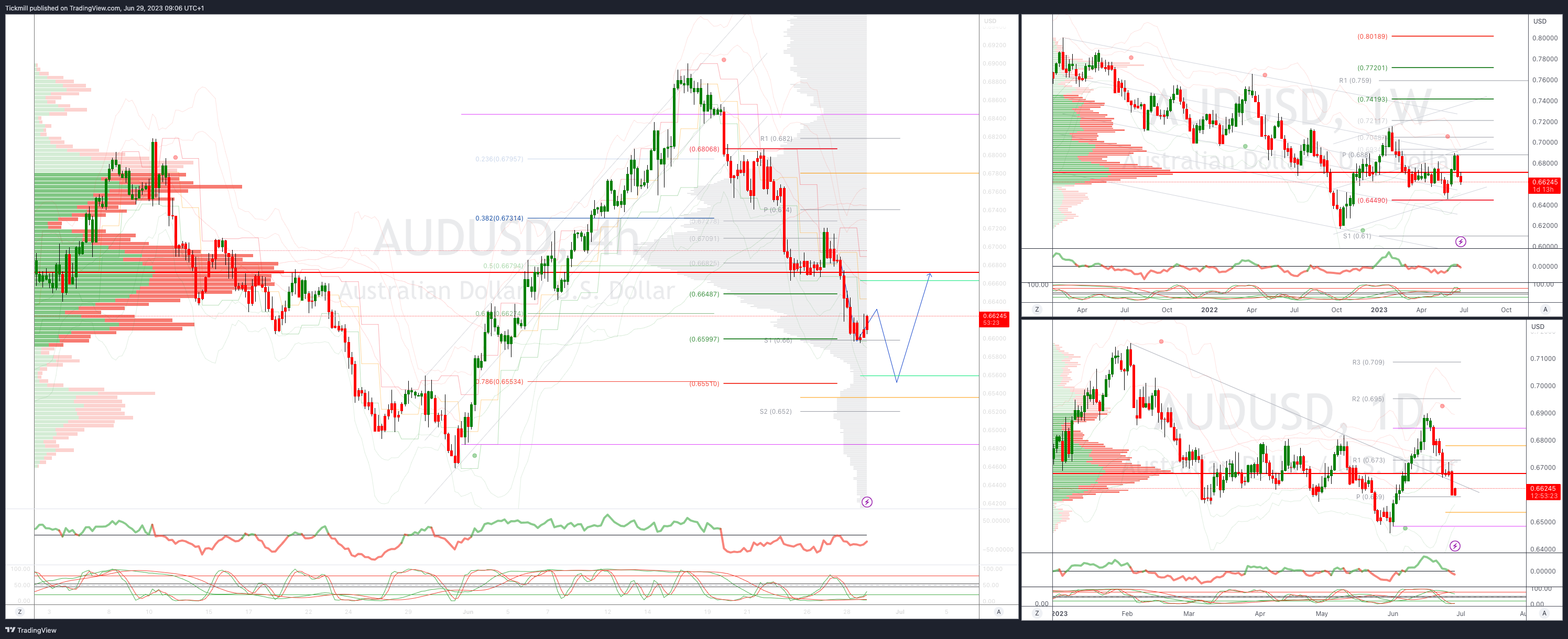

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6648

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bearish

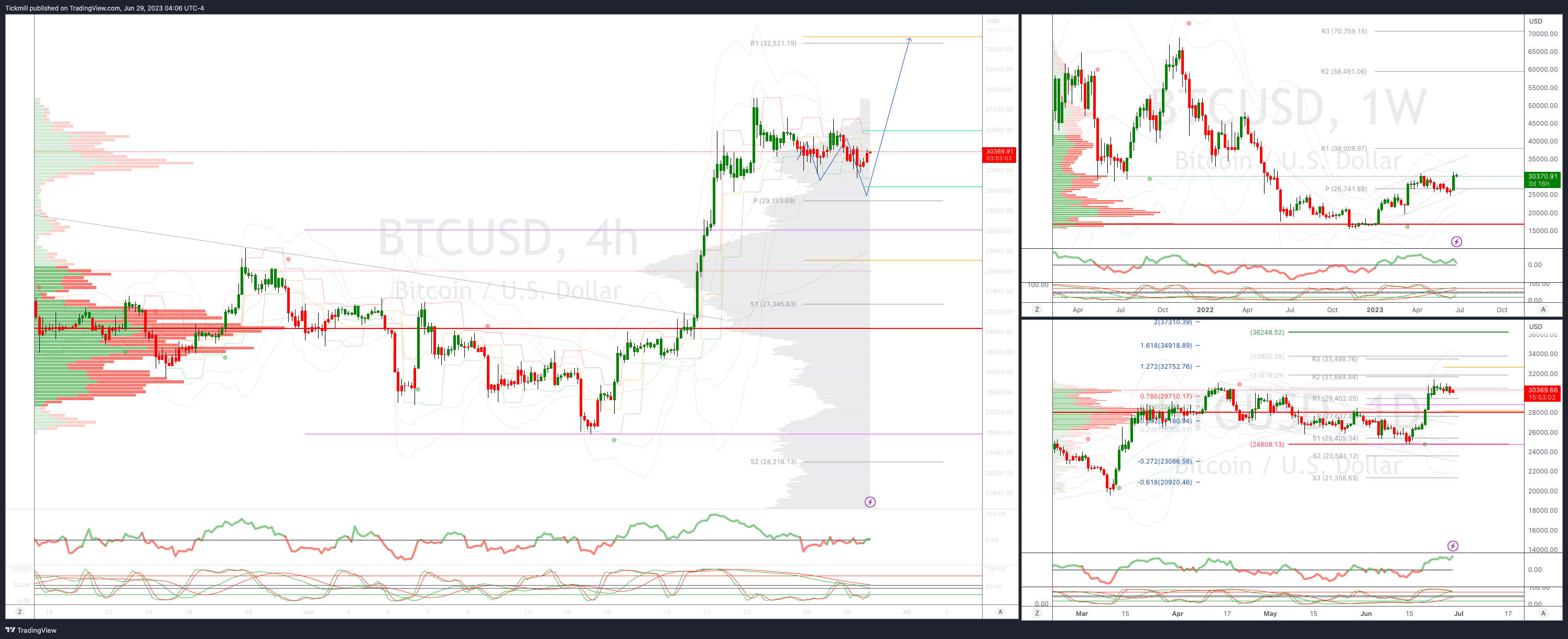

BTCUSD Intraday Bullish Above Bearish below 29500

Below 28000 opens 26900

Primary resistance is 27400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有72%和73%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。